Not a Deal-Breaker: Student Loan Debt and Missions

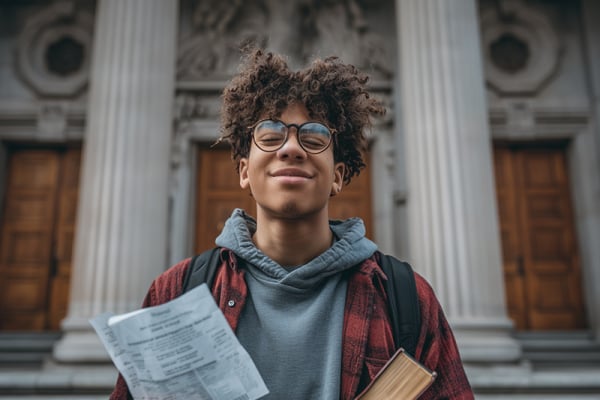

It’s not just an excuse. Student loan debt is a common reality among those considering missions, and for many it can be a serious hindrance to pursuing full-time cross-cultural ministry. Earning a degree to help you serve well can result in years or even decades of payments, as well as delays in reaching the field.

While skipping college might seem like an obvious way to avoid student loan debt, it’s a choice that can seriously limit your options. The GO Fund, a program of AIRO, reports that 60% of the unreached live in countries that are closed to Christian workers but open to college graduates. And, even in the countries that cross-cultural workers can enter without a college education, a degree opens opportunities for ministry as well as integration within least-reached communities. For the majority of people who want to serve in places where the gospel isn’t yet known, a college education is an investment in both access to the field and effective ministry.

The good news is that student loan debt doesn’t have to be a deal-breaker. It could even be an opportunity for you to experience the Body of Christ at work in a new way. Below are three strategies that can help to prevent debt from becoming a barrier to cross-cultural ministry.

1. Start With Stewardship

Your approach to debt—and to money in general—springs from your view of stewardship. So, the issue of student loans isn’t just a matter of dollars but a matter of the heart. While the practical implications of good stewardship vary according to each person’s situation, at the root of it is the belief that everything you have belongs to God and that He calls you to manage it well.

Addressing debt from the front end, preventing it from accumulating in the first place, can be a solid strategy that can help you get to the field after graduation. While completely avoiding student loans is a massively tall order for many students, especially for those in professional degree programs, taking small steps to minimize the amount you borrow can go a long way in making debt less of a barrier.

These steps range from small acts of savings like opting to brew your own coffee rather than stopping for a latte to more drastic efforts such as taking a semester off to work. The path of stewardship looks different for each person—for example, working 20 hours a week is doable for some full-time students, but for others it’s a path to burnout. So prayerfully consider how God is calling you to use your resources well. (The book The Treasure Principle by Randy Alcorn is an excellent tool that can help you learn to view money through the lens of stewardship.)

2. Pay it Off as You Go

If you’ve already accumulated student loan debt, don’t just assume that you need to wait until it’s been fully paid off to leave for the field. Each organization handles debt differently, so ask the ones you’re considering about their policies and learn about your options. Christar, for example, allows individuals who owe $20,000 or less to include their student loan payments in their support figures, enabling them to pay off their debt while on the field.

If you struggle with the idea of allowing others to help you pay off your debt, consider why. While personal responsibility is a valuable and godly quality, it doesn’t exist in a vacuum apart from stewardship. Before dismissing an option that would allow the Body of Christ to come alongside you and help you reach the field sooner, consider the big picture, remembering that you are a steward of not only your money but also your talents, knowledge and experience. Weigh the cost of the time you’d spend satisfying your debt on your own and remember that those who’d give toward your support are also stewards.

3. Be Blessed by The Go Fund, a Program of AIRO

If you owe more than the limit set by the agency with which you’d like to serve, you may be able to receive assistance from a ministry dedicated to eliminating student loan debt for followers of Christ who want to serve cross-culturally.

Christar partners with The Go Fund, a program of AIRO, which pays 100% of student loan debt for approved cross-cultural workers. This organization covers the monthly student debt payments of accepted candidates while they are serving long-term among the unreached. And applicants who plan to serve with Christar are preapproved! Learn more about Christar’s partnership with The GO Fund and how it could help you at thegofund.com/christar.

Whether you’re just starting to consider your options for cross-cultural ministry or have graduated and are ready to go, we’d love to come alongside you in every aspect of your journey, including addressing student loan debt. Just email [email protected] to connect with us.

_1724957011_600x400.png)